When considering any type of investment, it’s a best practice to perform a significant amount of due diligence before deploying your hard earned money into it. Depending on the opportunity, this can be tough because the evaluation metrics for each asset class are different and it’d be incredibly time consuming to know all of them. For example, when analyzing a stock purchase, it’s important to evaluate a company’s share price relative to their earnings or when looking at a bond purchase it’s important to calculate metrics like duration and yield.

With regard to a private real estate investment, there are dozens of possible metrics used to evaluate a deal’s return or to compare one deal to another, but six of them stand out as being critically important (NOTE: Click on the link to jump directly to that section):

- Net Operating Income

- Cash on Cash Return

- Capitalization Rate

- Internal Rate of Return

- Equity Multiple

- The Fee Structure

In this article, we’re going to take a detailed look at each one means and review how they’re calculated and why they matter.

But, before we do that, let’s set up an example scenario to illustrate how each metric works.

Example Scenario

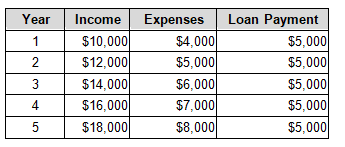

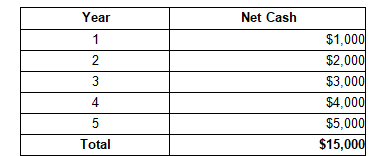

Assume that a real estate investor is evaluating a property that has a purchase price of $100,000. To complete the transaction, they’re going to invest $20,000 of their own money (20%), and get a loan for the difference, $80,000 (80%). Their holding period is five years and they’ve projected that the property produces the following series of cash flows[1]:

With an example established, let’s dig into the specifics of how to calculate each metric.

Net Operating Income

Many commercial properties are income producing and the foundational metric for understanding performance is called Net Operating Income (NOI).

What it is

Net Operating Income is defined as a property’s income less expenses. It’s expressed as a dollar figure and is usually quoted in monthly terms, say $5,000, or annual terms, say $60,000.

Why It Matters

Net Operating Income is important because it’s a measure of a property’s profitability and it’s a key input into the valuation calculation. The higher the NOI, the more valuable the property and there are three ways to improve it: increase income, decrease expenses, or both.

How It’s Calculated

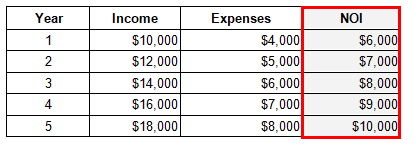

Because we know income and expenses from the example above, we’re able to calculate Net Operating Income fairly easily:

Cash on Cash Return

Net Operating Income factors significantly into the calculation of other metrics so let’s look at those next, starting with the Cash on Cash return.

What it is

The Cash on Cash (CoC) return is a measure of the return on each dollar of cash invested and for many investors, it’s a preferred return benchmark.

Why It Matters

Cash on cash return matters because it’s an indication of an investment’s profitability. Although return requirements vary from one investor to another, a good CoC return is north of 5%, but many investors prefer 10% or higher.

How It’s Calculated

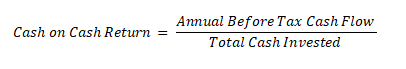

The cash on cash return (CoC) is calculated as the ratio of an investment’s annual before-tax cash flow to the amount of cash invested. It’s typically expressed as a percentage and the formula looks like this:

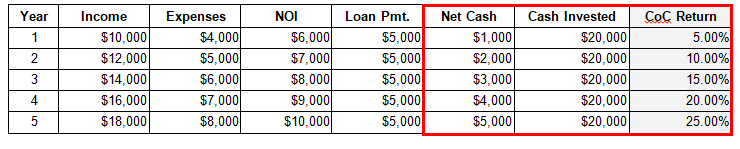

Building on the example from above, the CoC return is calculated annually, based on the amount of cash flow produced after the loan payment has been made. The calculation looks like this:

Cash on Cash return is an important metric, but shouldn’t be considered in isolation. It should be evaluated relative to similar properties in the same market. For example, a 25% return in year five seems great, but what if comparable properties in the same market are returning 30%? Then, it doesn’t seem as good.

Capitalization Rate

What It Is

The Capitalization or “Cap” rate is a versatile metric that is used in two ways: to determine the value of a property or to compare the value of one property to another.

Why It Matters

Aside from being used to determine the value of a property, the cap rate is important because it stands as a proxy for the level of risk associated with an individual property. Generally speaking, the lower the cap rate in real estate, the less risk associated with a property. Conversely, the higher the cap rate, the riskier the property because an investor demands a higher return.

How It’s Calculated

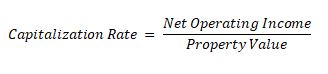

The Cap Rate formula looks like this:

To illustrate how the Cap Rate works with our example, let’s look at the same series of cash flows. Remember the purchase price is $100,000:

Internal Rate of Return (IRR)

What It Is

Internal Rate of Return or IRR, is an advanced return concept defined as the rate of return earned on each dollar invested, for each period of time that it’s invested in. It’s often used as a proxy for the interest rate and the formula for calculating it requires a bit of trial and error because it’s the rate of return that sets the Net Present Value (NPV) of all future cash flows (positive and negative) equal to zero.

Why It’s Important

The Internal Rate of Return is a measure of the compound rate of return over the entire holding period and it’s important because it accounts for the time that the cash is invested, which isn’t the case for the Cash on Cash Return.

How It’s Calculated

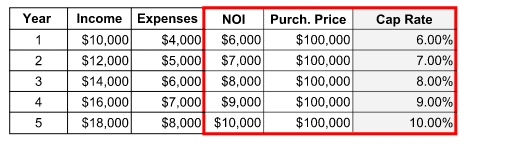

Mathematically, the formula for NPV looks like this:

If that formula seems intimidating, it is, but don’t worry about it. Luckily, there’s a spreadsheet function that makes the calculation very simple. The syntax looks like this:

IRR = (Cash Flow 1, Cash Flow 2, Cash Flow 3…)

To illustrate exactly how this works, let’s continue our example from above. As a reminder, the series of cash flows looks like this (NOTE: we’ve included a “year 0” to account for the purchase of the property):

Using the spreadsheet function, the cash flows are entered like this:

= IRR(-$100,000, $1,000, $2,000, $3,000, $4,000, $5,000)

The resulting IRR is -37.85%, which illustrates why it’s a good idea to look at multiple return metrics. While the Cash on Cash return looked great, the IRR looks poor. Why? Because the property doesn’t produce enough cash relative to the initial investment and during the five year holding period.

Again, return requirements may vary from one investor to another, but a good IRR is generally in the neighborhood of 15.00%.

Equity Multiple

What It Is

The Equity Multiple is another measure of profitability, but this time it’s a ratio used to indicate the total return on an investment.

Why It’s Important

Equity Multiple is often used in conjunction with IRR because they compliment each other well. Where IRR does a good job of calculating compound annual returns, it doesn’t do a very good job of calculating absolute returns, which is where the Equity Multiple excels.

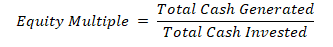

How It’s Calculated

The Equity Multiple is calculated as the ratio of the total cash produced by a property to the total cash invested. The formula looks like this:

The Equity Multiple is expressed as a number and let’s continue with our example to illustrate it. Remember, the initial cash investment was $20,000 and the property produced the following cash flows:

For an initial cash outlay of $20,000, the investment returns $15,000, which results in an Equity Multiple of .75X, which isn’t very good.

Ideally, the Equity Multiple is greater than 1.00X, and the preferred range is greater than 1.50X. But, remember, the Equity Multiple doesn’t account for time. An Equity Multiple of 1.50X may be great, but if it takes 10 years to earn it, it isn’t as good. This is exactly why it’s a good complement for IRR, and why it’s a good idea to look at them together.

Fee structure

The last major metric to discuss is the fee structure.

What It Is

Typically, private real estate investment managers charge a fee for handling things like property selection, underwriting, closing, and management.

Why They’re Important

The fees associated with a private real estate investment can potentially affect returns so it’s important to know what they’re for and how much they are. Further, to be able to accurately compare one opportunity to another, fees are an important part of the evaluation.

How They’re Calculated

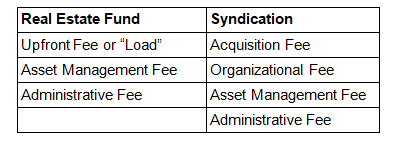

There isn’t a specific formula to calculate fees, but they’re an important part of understanding how an investment is structured and how it compares to other opportunities. There are two common structures used in private real estate transactions, one is a real estate fund – where money is pooled for the general purpose of investing in real estate, and the other is a syndication where money is pooled for the specific purpose of investing in a single deal. Their fee structures vary and typically include things like:

One fee structure isn’t necessarily better than the other, they’re just different and it’s important to be aware of what the fees are to make an accurate comparison across investment opportunities.

Interested In Learning More?

First National Realty Partners is one of the country’s leading private equity commercial real estate investment firms. With an intentional focus on finding world-class, multi-tenanted assets well below intrinsic value, we seek to create superior long-term, risk-adjusted returns for our investors while creating strong economic assets for the communities we invest in.

Whether you’re just getting started or searching for ways to diversify your portfolio, we’re here to help. If you’d like to learn more about our investment opportunities, contact us at (800) 605-4966 or ir@fnrpusa.com“>ir@fnrpusa.com for more information.

[1] Example is for illustrative purposes only and is not indicative of a specific property.