Investing in What Communities Need, Delivering What Investors Want.

Our track record in necessity-based commercial real estate reflects strategic acquisitions, expert management, and successful dispositions in thriving markets, highlighting our focus on delivering lasting value for investors.

FNRP By The Numbers

$2B+

Assets Under

Management

12M+

GLA Under

Management

Management

26

States

65+

Owned Assets

$140M+

Total Investor

Distributions

Since Inception

Distributions

Since Inception

3000+

Investors

All amounts are as of 6/17/2025.

Securities are only available to verified accredited investors who can bear the loss of their investment. Please contact FNRP for an explanation of how such numbers are calculated. Past performance may not be indicative of future results. An investment in real estate is speculative and subject to risk and as such there cannot be any assurance, promise or guarantee as to the final results of any specific investment or investment strategy into securities offered by FNRP or that such investment will achieve specific investment goals.

Investment Activity Since 2023

10

Properties Acquired

$229,455,000

Total Purchase Price

$135M

Total Equity Raised

5.4%

Period to Date Actual Cash-on-Cash Return

5.3%

Period to Date Average Marketed Cash-on-Cash Return

91.8%

Average Current Occupancy

The information contained herein covers the period of 2023 to 2025, is for informational purposes only and is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon as such. Before making any investment decision, it is recommended that you seek advice from a qualified advisor. An investment in commercial real estate, particularly through a private placement, is speculative and involves a high degree of risk, including the risk that all of your investment may be lost. Certain financial information shown above, including cash on cash returns and other such statistical information, is historical and past performance is no assurance or indicator of future returns or future performance. Cash on cash returns, occupancy, and other financial performance metrics will fluctuate. Such financial information is blended across our investments during the relevant time period, and may not reflect commissions, transaction costs or such other fees and expenses which may have been applicable, or income taxes payable by any investor, which would have the effect of reducing historical returns. Actual cash-on-cash returns are calculated by annual cash flow return on invested equity over the projected hold period. Please contact FNRP for further detail and explanation on how such numbers were calculated.

The information displayed here was last updated on 03/14/2025.

The information displayed here was last updated on 03/14/2025.

Select Dispositions*

- Ashland, Virginia

- Grocery-Anchored Shopping Center

Ashland Hanover Shopping Center

- Purchase Price: $17,750,000

- Exit Price: $22,500,000

- Net IRR: 6%1 IRRs are net to the investors after fees.

- Equity Multiple: 1.2x2

- Grocery-Anchored Shopping Center

- Sun Prairie, WI

- Single Tenant Grocer

Single Tenant Pick n’Save

- Purchase Price: $13,000,000

- Exit Price: $17,075,000

- Net IRR: 45.0%1 IRRs are net to the investors after fees.

- Equity Multiple: 1.41x2

- Single-Tenant Freestanding Grocer

- Old Bridge, NJ

- Industrial/ Flex Park

Colony Business Park

- Purchase Price: $8,250,000

- Exit Price: $11,350,000

- Net IRR: 13.9%1 IRRs are net to the investors after fees.

- Equity Multiple: 1.71x2

- Value-Add Flex Office Space

- Mays Landing, NJ

- Retail Strip Center

Lenape Plaza

- Purchase Price: $2,375,000

- Exit Price: $4,118,066

- Net IRR: 13.5%1 IRRs are net to the investors after fees.

- Equity Multiple: 1.31x2

- Core-Plus Deal

Previous

Next

*Past performance may not be indicative of future results. An investment in real estate is speculative and subject to risk and as such there can be neither any assurance as to the final results of any such specific investment nor can there be any assurance that any investment strategy into securities offered by FNRP will achieve specific investment goals. Each fund managed by FNRP has had specific results to date and we do not value the underlying assets in these funds during time of ownership but can provide other performance results upon request. Investors should note that the properties above are select properties with select results, and FNRP has had other funds and properties with varying results and performance. Please contact FNRP if you wish to obtain an explanation on how such results were calculated or if you wish to obtain information on other investments. Securities are only available to verified accredited investors who can bear the loss of their investment.

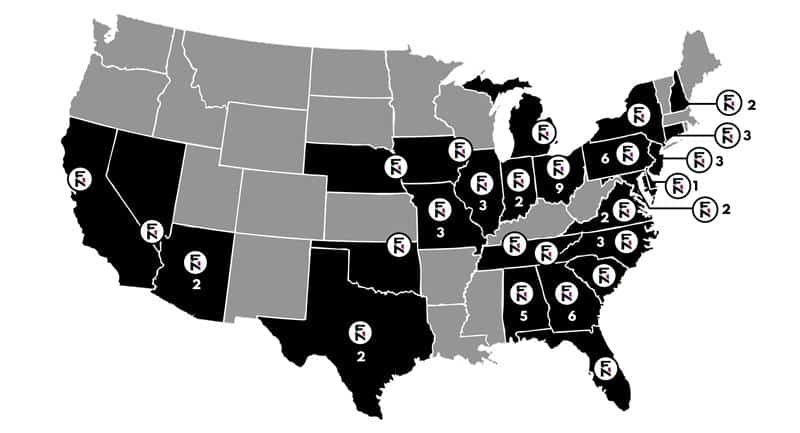

Actively Managed Investments

Select a state below to see details on the properties managed.

Executive Experience

Every investment in our portfolio represents the skill, dedication, and strategic insight of our highly experienced team. At FNRP, our seasoned professionals bring decades of industry knowledge to the table, analyzing every aspect of a transaction to identify and secure the highest-quality commercial real estate assets. From due diligence to deal structuring, we harness extensive resources and a deep network of industry relationships, ensuring that each transaction meets our rigorous standards of excellence and delivers enduring value to our investors.

141M

SF of Deals Worked On

177

Years of Combined Experience

$30B+

Transaction Experience

What Our Investors Are Saying3

"I trust their process because of their stability and the returns they provide. This is the best business model out there right now."

Vasco GFNRP Investor

"At FNRP, there's not a day that doesn't go by that I don't feel confident I can get in contact with anyone in the company."

Dennis CFNRP Investor

"With FNRP it really feels like they are looking out to just provide you the information so that you can make informed decisions."

Avinash SFNRP Investor

"Very smooth process investing with FNRP. Everyone was helpful and courteous. I’ll be on the lookout for future deals to enhance my portfolio."

Steven WFNRP Investor

"My experience as a first time investor with FNRP has been very positive, and I look forward to a long and profitable relationship with them."

Sharon FFNRP Investor

"This was my first syndicated investment and even as a 1031, their team was responsive and helpful throughout the process. Great choice for passive investments!"

John MFNRP Investor

"Been doing business with them for 8 deals over the last 12 months. They deliver results and are very transparent with the partners. Ready to do another deal."

Bill CFNRP Investor

"FNRP has been most professional in our interaction. It is a well run company with interesting investment proposals, well researched and good track record."

Karina BFNRP Investor

"Sign up process was smooth and hassle free. Now to sit back and see how their projects create income and opportunities."

Terry MFNRP Investor

Previous

Next

- Net IRR is defined as the annualized, compound rate of return using equity contributions and distributions as they occurred on specific dates during the investment period. Net IRR is reflective of all fees charged and paid to First National Realty Partners LLC and its affiliates and subsidiaries.

- Equity Multiple: the total distributions and remittances to equity investors divided by the total equity contributions from investors during the investment period. Equity Multiple is reflective of all fees charged and paid to First National Realty Partners, LLC and its affiliates and subsidiaries.

- The testimonials provided herein are from FNRP investors. Prospective investors are cautioned as to any inherent conflict of interest which may exist between the investors and FNRP as a result of this relationship. Further, their representations provided may not be representative of the experience of other investors. Any testimonials provided are not a guarantee of future success.