Every real estate investor, whether they focus on commercial or residential property, has their own set of requirements that they use to determine whether or not an investment property is worth purchasing.

In commercial real estate investing, there are two widely used methods of measuring returns on a real estate investment: capitalization rate (“cap” rate) and return on cost.

Cap rate and return on cost each have their own strengths and weaknesses for measuring real estate returns, but both metrics are useful when evaluating a property’s risk/return profile. This article explains more information about cap rate and return on cost, including what these metrics are and when to use them.

FNRP’s investment strategy is focused on acquiring market-dominant, grocery-anchored retail shopping centers at a significant discount to replacement cost. Our strategy seeks to create long-term, risk-adjusted returns for our investors. Click here to see FNRP’s exceptional CRE opportunities for accredited investors.

What is a Cap Rate?

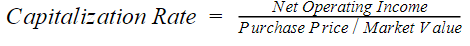

A property’s capitalization rate, or “cap rate,” represents the ratio of a property’s Net Operating Income to its purchase price. The result of the cap rate calculation is expressed as a percentage, but, it’s what the cap rate represents that may be more important. Intuitively, cap rate represents the “rate of return” that an investor could expect on an all cash purchase of real estate in the first year of ownership.

Mathematically, the calculation for cap rate is Net Operating Income (NOI) divided by the purchase price or market value:

For example, if a property generates $1 million in Net Operating Income (NOI = total income minus operating expenses) in year 1 and the purchase price was $15 million, the resulting cap rate of 7% represents the year one annual return.

However, it is important to note that the cap rate only measures one point in time and could represent different streams of cash flow. A cap rate could represent the trailing 12 months’ NOI, in which case it would be referred to as the “trailing cap rate.” Or, it could represent the anticipated year 1 cash flow, in which case it would be referred to as the “initial cap rate.” It is always important to specify which cap rate is used.

While the cap rate calculation itself may be simple, the logic behind it is anything but. The denominator in the cap rate equation, purchase price, can be influenced by a variety of factors, including location, tenant base, rental rates, and in-place leases. For example, a property located in a strong market like Denver, CO, with long term leases in place and financially secure tenants is likely going to sell for a higher price than a similar property located in Omaha, NE, with short term leases and marginal tenants.

When to Use the Cap Rate Calculation

There are three distinct scenarios where the cap rate calculation can be very useful in determining an individual’s real estate investment strategy:

1. Property Comparison

When making investment decisions with two similar commercial properties, their respective cap rates allow for a quick comparison. If one property has a good cap rate of 5% and the other property has a higher cap rate of 10%, the risk premium for the second property implies that there is some sort of issue with it that warrants a lower price and/or closer inspection.

2. Trend Comparison

Studying the trend of cap rates in a particular real estate market can be a useful indicator for how the market perceives the asset or asset class. If the cap rate trend is down (which is good), it could be an indication of strong demand and a clue as to where market values are headed.

3. “Back of the Envelope” Calculations

Rearranged, the formula for the cap rate can also be used to make a back of the envelope calculation for purchase price or valuation if the NOI is known. For example, if we are evaluating a property where the NOI is $100,000, and we know that the cap rates for similar properties in the same market are around 7%, we can quickly estimate a potential market value of the property of $1.42 million.

Limitations of the Cap Rate Calculation

As useful as it is, there are some limitations to using the cap rate as a way to estimate a property’s purchase price and/or potential return. If the target property has irregular cash flows, or if it is a value add opportunity, cap rate isn’t very useful because it depends on consistent cash flows.

For example, the income for an obsolete multifamily property with 40% occupancy probably isn’t enough to cover expenses, resulting in a negative cap rate.

However an investor may view this as an opportunity to purchase the property, repair it, and lease it up, resulting in a series of increasing cash flows – and cap rates – over time. Where the cap rate may have been negative at the time of the acquisition, it may end up in positive territory when the repairs and stabilization are complete. In such a scenario, the return on cost may be a more valuable metric for measuring real estate returns.

What is Return on Cost?

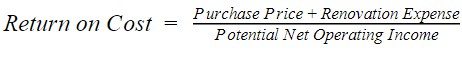

Return on cost is similar to the cap rate but is a forward-looking metric because it accounts for the costs needed to stabilize a rental property and the resulting NOI once stabilized. Return on cost is useful because it allows an investor to compare the return that they may earn on a series of stabilized cash flows today to the annual income that they could earn in the future.

Mathematically, the return on cost calculation is the purchase price plus renovation expenses divided by potential NOI:

Notice that the denominator in the return on cost formula is potential NOI, which may be two or three years in the future, once renovations are complete and the rental income has been boosted to increase the return on investment.

Ultimately, investors may use return on cost to try and determine if it is more advantageous to pay more to purchase a property with stabilized cash flows or pay less for a property that could potentially have higher cash flows. To illustrate this point, consider the example below where an individual is deciding between two different investment options.

Return on Cost Example

Suppose an investor is thinking about paying an asking price of $10 million for a 100% occupied, fully stabilized apartment building that generates $1 million in NOI today, implying a 10% cap rate ($10,000,000 / $1,000,000). Or, the investor could purchase a value-add property with 60% occupancy for $7 million that needs $3 million worth of work. At the time of purchase, the property has $600,000 in NOI, but once the renovations are completed, it will produce $1.2 million in NOI.

Using the formula above, the return on cost is 8.33% ($7,000,000 + $3,000,000 / $1,200,000). So, for the same initial investment of $10 million, the investor is able to purchase a larger stream of income in the future. Applying the same 10% cap rate to the $1.2 million in future NOI implies a value of $12 million. By purchasing the asset with more risk and executing a successful turnaround plan, the investor has turned the same $10 million investment into a larger profit.

Interested in Learning More?

First National Realty Partners is one of the country’s leading private equity commercial real estate investment firms. With an intentional focus on finding world-class, multi-tenanted assets well below intrinsic value, we seek to create superior long-term, risk-adjusted returns for our investors while creating strong economic assets for the communities we invest in.

We use both the return on cost and cap rate formulas to evaluate potential investments. If you would like to learn more about our investment opportunities, contact us at (800) 605-4966 or ir@fnrpusa.com for more information.