Fundamentally, the principles of commercial real estate investment are fairly simple, an individual or company purchases an investment property, like an office building or retail property, and leases the space in it to other individuals or companies for a rental fee. As long as those fees are more than it costs to operate the property, the investment is “cash flow positive” and the owner is earning a return on their capital.

These income and expense numbers are fairly easy to track and quantify in pursuit of calculating a return. But, they fail to capture the amount of time that an owner has to commit to managing the property. This is a metric we call management intensity.

What is Management Intensity?

Time is money and Management Intensity is the term that commercial real estate industry professionals use to describe the amount of time that it takes for a building owner to manage their commercial property. Generally, management intensity exists on a spectrum and varies by property. On the low end is something like a Class A absolute triple-net leased commercial building or office space with a single tenant who has a strong commercial credit rating, like a Walgreens or CVS. These properties have a low degree of management intensity because the tenant is responsible for everything that happens. For example, if there is a roof leak or electrical issue, it is the tenant’s responsibility to fix it and the property owner does not have to get involved.

On the other end of the spectrum would be something like a large multifamily property. These have a high degree of management intensity because they involve a large number of individuals and the space they call home. To manage this property efficiently, an onsite asset management team is needed to handle things like: leasing activity, maintenance requests, lockouts, parking issues, rent collection, delinquencies, and evictions. And, some of these tasks are not accomplished during “normal” business hours. Appliances tend to break in the middle of the night and lockouts tend to happen on weekends. As a result, the time needed to address these issues can be significant and should be accounted for in the property’s business plan.

Factors that Contribute to Management Intensity

The examples above the extreme ends of the management intensity spectrum. In reality, most properties fall somewhere in between based on the following attributes:

- Number of tenants

- Number of management services offered

- Lease structure (e.g. Gross vs. Net)

- Lease length (e.g. short-term vs. long-term)

- Number of financial transactions

- Age of the building

- Property type (e.g. Commercial vs. Residential)

- Size of Common Areas

- Vacancy Downtime Factor

- Location / Property Market – Commercial real estate (CRE) markets will have different needs.

- Market conditions

If a property has a high degree of management intensity, it doesn’t necessarily make it a bad investment, it just means that it needs to be planned for. In fact, properties that require a lot of management oversight can present an excellent opportunity for an investor or asset manager with a high degree of operational expertise.

Management Intensity – Why it Matters

Although there isn’t a specific “management intensity” line item on a property’s Profit & Loss statement, there is a direct financial impact. Usually, it can be found under the “Property Management” line item. In many cases, a property owner, especially those with large portfolios, will hire a third-party property manager to oversee the day to day operations of an asset. The fee for the property management firm’s services varies from 3% – 9% of the asset’s Gross Income and, in a large property, this can be significant.

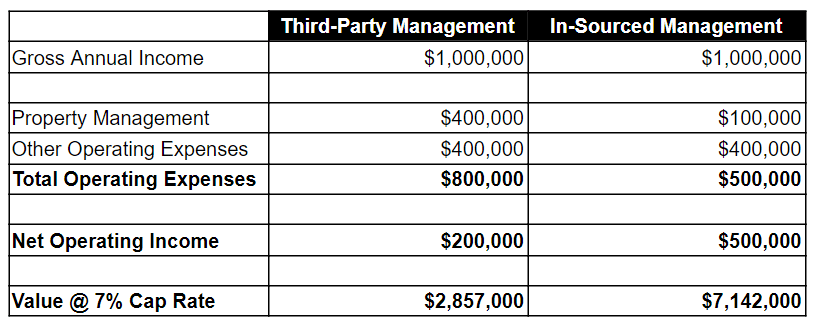

In our case, we are a “vertically integrated” firm, which means that we have an in house property management team to oversee the day to day operations of our assets. By “insourcing” this function, we are able to provide significant cost savings to the property and add immediate value to the asset. To understand how this works, assume that we are considering the purchase of a property that has $1,000,000 in Gross Annual Rent and property management fees of $400,000. The following table illustrates the potential value-add by insourcing this function:

Now, this example is purposely extreme to demonstrate the broader point, if a property has a high degree of management intensity, vertically integrated firms (like ours) can insource this function and perform it themselves. In doing so, they can add significant value to the property and deliver strong returns for their investors.

Interested in Learning More?

First National Realty Partners is one of the United States’ leading private equity commercial real estate investment firms. With an intentional focus on finding world-class, multi-tenanted assets – including service-oriented retail shopping centers – well below intrinsic value, we seek to create superior long-term, risk-adjusted returns for our investors while creating strong economic assets for the communities we invest in.

Whether you’re just getting started or searching for ways to diversify your portfolio, we’re here to help. If you’d like to learn more about our retail investment opportunities, contact us at (800) 605-4966 or send us an email at ir@fnrpusa.com for more information.