One of the most important line items in any commercial real estate proforma is the property’s vacancy rate. However, vacancy rate is a commonly misunderstood term as there are actually two types of vacancy: physical vacancy and economic vacancy.

In this article, we’ll define physical vacancy and economic vacancy, show how to calculate them, and explain what commercial real estate investors need to know about the differences between them.

What is Physical Vacancy?

Physical vacancy is the percentage of a property’s units that are unoccupied. When referring to a property’s vacancy rate, it is likely that most investors are talking about its physical vacancy.

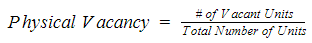

How to Calculate Physical Vacancy

The basic formula for calculating physical vacancy is the total number of vacant units divided by the total number of units:

For example, if a multifamily apartment building has 100 available units and 90 of them are currently occupied, the property has a physical vacancy rate of 10% (10/100).

However physical vacancy is often calculated over the course of a year, so the above formula tends to be overly simplistic. It is more accurate to account for the amount of time that the unit is vacant. For example, suppose the 10 units above were vacant for 6 months out of the year. The more accurate calculation for physical vacancy is to divide six months by 12 months (.5) and multiply the result by the physical vacancy percentage (10%). By doing this, the physical vacancy rate falls to 5%.

Since there are some limitations to the physical vacancy calculation, sophisticated investors usually prefer to calculate a property’s economic vacancy instead.

What is Economic Vacancy?

Economic vacancy is the difference between a property’s gross potential rent and the actual rent collected. The benefit of this definition is that it incorporates other factors beyond just vacant units. Economic vacancy also includes occupied units that aren’t paying rent, such as units that are occupied by a property manager, units that are down for repairs, and the impact of rental concessions.

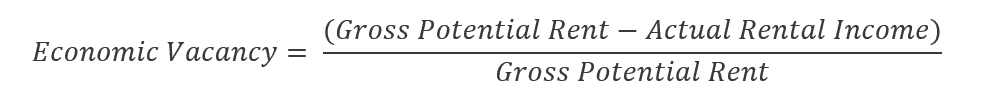

How to Calculate Economic Vacancy

The formula for calculating economic vacancy is gross potential rent minus actual rental income divided by gross potential rent.

To illustrate how economic vacancy works, let’s continue with the example from above. Assume that the 100 units have an average rental rate of $1,000 per unit, per month. On an annual basis, the gross potential rent is $1,200,000 ($1,000 * 100 * 12). Now assume that there are 10 vacant units, 3 units that are used as models by the property manager, 3 units that are currently being renovated, and 5 units that required 1 month of free rent to get the tenant to sign a lease. The income loss from these units is calculated as:

- Vacant Units: 10 Vacant Units * $1,000 per month * 12 months = $120,000

- Model Units: 3 Units * $1,000 per month * 12 Months = $36,000

- Renovated Units: 3 Units * $1,000 per month * 12 Months = $36,000

- Rental Concessions: 5 Units * $1,000 per month * 1 Month Free Rent = $5,000

The sum of this lost income is $197,000, which means that the actual income is $1,003,000 ($1,200,000 – $197,000). So, economic vacancy is:

Economic Vacancy = ($1,200,000 – $1,003,000) / $1,200,000 = 16.41%.

This larger vacancy number provides a more realistic depiction of the total number of units that are vacant and the impact of the lost income.

Why The Vacancy Rate Matters

When underwriting a commercial real estate investment, prospective property owners must pay close attention to the vacancy line item in the proforma. Beyond how vacancy is calculated, it is what it stands for that is the more important consideration. The resulting percentage is a metric that represents a certain number of units that aren’t earning any income. The ultimate impact of this reduces both the property’s gross income and net operating income (NOI), which also impacts its valuation.

If a commercial property has a high vacancy rate at the time of purchase, one of the most obvious ways that investors can add value is to immediately reduce it. In the example above, this could mean reducing the number of units used as models, speeding up renovations to get the units back to market, or by reducing/eliminating rental concessions. Or, it can also mean finding new tenants to occupy the space at the prevailing market rent. Filling these spaces will increase income and the value of the property.

A Note About Economic Occupancy and Physical Occupancy

This article is about the difference between physical vacancy and economic vacancy, which implies that space is empty. However, these terms can also be referred to in their inverse, which would be physical occupancy and economic occupancy. For example, if a property has 10% physical vacancy, it also means that 90% of the property’s units are not vacant. So, it is important not to confuse the terms or to use them interchangeably because they mean different things.

Interested In Learning More?

First National Realty Partners is one of the country’s leading private equity commercial real estate investment firms. We leverage our decades of expertise and our available liquidity to find world-class, multi-tenanted assets below intrinsic value. In doing so, we seek to create superior long-term, risk-adjusted returns for our investors while creating strong economic assets for the communities we invest in.

If you are an Accredited Investor and would like to learn more about our investment opportunities, contact us at (800) 605-4966 or ir@fnrpusa.com for more information.