It is widely agreed that a property’s location is one of the most important predictors of a successful commercial real estate investment. Thus, detailed and thorough market research is necessary to ensure that the property is located in a vibrant and growing market.

However, this can be a considerable challenge since the United States is such a vast country with thousands of different markets, big and small. From Atlanta to Dallas, New York to San Francisco, each market is unique, and the amount of available data can vary widely. Fortunately, a government agency took the lead many years ago and created a standardized way to identify commercial real estate markets and to collect data on them.

What is a Metropolitan Statistical Area (MSA)?

A Metropolitan Statistical Area (MSA) is defined by the United States Office of Management and Budget (OMB). The general concept is “that of a core area containing a substantial population nucleus, together with adjacent communities having a high degree of economic and social integration with the core.” In order to qualify as an MSA, there must be a population of at least 50,000 people.

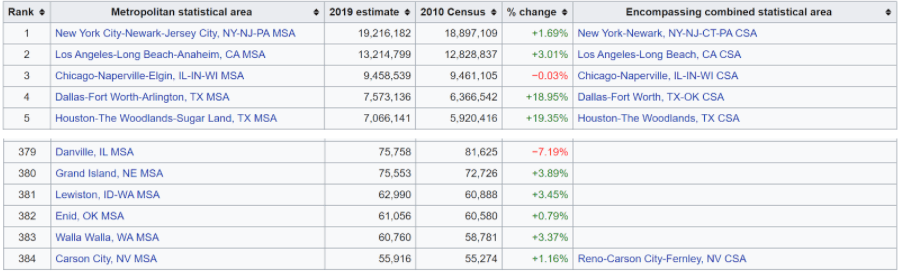

Based on these criteria, the OMB has identified 392 Metropolitan Statistical Areas in the United States. They include the largest metros like New York/New Jersey, Los Angeles, and Seattle. But they also include smaller markets like Denver, Omaha, and Orlando. The following table shows the five largest and five smallest MSAs, as defined by the OMB (Per Wikipedia):

From the table, it is apparent that there is a substantial difference between the largest MSA, New York-Newark-Jersey City with 19M people, and the smallest MSA, Carson City, NV with 56,000 people. From a real estate investor’s standpoint, these are substantially different markets with different price points, different product needs, and different growth trajectories.

Why MSAs Are Important In Commercial Real Estate Investment

If it were possible to sum up the importance of an MSA to commercial real estate investment in one word, it would be “data.” Government agencies and data providers aggregate key market data by MSA and deliver it to users in this format.

For example, one of the most important indicators of a real estate market’s health is the number of jobs that are produced in a given year. This data can be obtained from the United States Bureau of Labor Statistics (BLS), which aggregates labor market data for specific geographic areas; alternatively, the U.S Census Bureau tracks data on the fastest and slowest growing MSAs, which can give investors important insight about population movements.

For individuals evaluating a potential real estate investment and performing the corresponding market research, one of the very first steps to take is identifying the MSA in which the property resides, and taking advantage of the data offered by providers to gain insight into the strength of the market.

But this begs a question: What happens if the property is not located in an MSA? What if it is located in a small market? Fortunately, the OMB captures these as well. They are called “Micropolitan Statistical Areas.”

What is a Micropolitan Statistical Area?

A Micropolitan Statistical area is defined as a city or market that has a population of at least 10,000 people, but fewer than 50,000. Data for these markets can be more difficult to come by because they are smaller and there is not as much investment activity. As a proxy, many investors will have to find the nearest MSA and extrapolate the data from that to gain insight into the property’s market.

For example, New Smyrna Beach is a small city on the east coast of Florida. It is a popular vacation destination and it has a population of about 25,000 people. Based on this size, it qualifies as a Micropolitan Statistical Area. However, it is located about 60 miles from Orlando, Fla—and in fact, Orlando-Kissimmee-Sanford is the 23rd largest MSA in the country, where there is a significant amount of data available. While this data is not perfect and should not be solely relied upon to make an investment decision, it can provide some directional evidence about the state of the smaller market(s) located nearby.

MSAs and Financing

The last point to make about the importance of Metropolitan Statistical Areas in Commercial Real Estate investment is that the property’s location has a significant impact on the financing terms available for it. Fundamentally, key loan parameters like LTV, interest rate, and term are a function of the lender’s perceived risk in the transaction. So a property that is located in a large market with strong occupancy—like Chicago—is more likely to receive a lower interest rate, lower DSCR requirements, and a better term than a property located in a place like New Smyrna Beach.

This is simply because dense, urban areas generally represent less risk for a lender. Transaction volume is higher, there is more competition for space, rents are more stable, and the property is more likely to be sold in a liquidation scenario when (if) the borrower defaults.

It should be noted, however, that there are a number of government programs—administered by the United States Department of Agriculture—whose sole purpose is to offer financing for properties located in rural areas where traditional commercial financing may be cost prohibitive. Terms and qualification requirements for these programs vary, but they are an important part of trying to provide opportunities for residents and investors of small markets.

Interested In Learning More?

First National Realty Partners is one of the country’s leading private equity commercial real estate investment firms. With an intentional focus on finding world-class, multi-tenanted assets well below intrinsic value, we seek to create superior long-term, risk-adjusted returns for our investors while creating strong economic assets for the communities we invest in.

To learn more about our real estate investing opportunities, contact us at (800) 605-4966 or ir@fnrpusa.com for more information.