When discussing the benefits of commercial real estate investing, many are quick to cite the cash flow generated by rental property leases or the capital appreciation driven by the supply and demand characteristics of a given market or improving Net Operating Income. While these are important benefits and material components of the total return, they don’t always tell the whole story. One of the most overlooked benefits are the tax advantages that are enabled by Internal Revenue Service (IRS) rules and modern accounting practices. Among the most significant are depreciation and the treatment of capital gains using a 1031 Exchanges.

What is Depreciation?

Real estate is a physical asset whose condition degrades over time. To account for this, tax rules allow a commercial property owner to “depreciate” the value of the asset a little bit each year and list the amount as an expense on the property’s income statement (similar to interest expense or property taxes). As a result, the property’s taxable income is reduced, which can result in significant tax savings over time. But, and this is key, depreciation is a non-cash expense so it does not affect the amount of cash available to be distributed to property owners and investors.

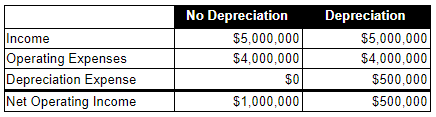

To illustrate the power of depreciation, consider a simple example. The table below shows a summary income statement with and without a depreciation line item on the income statement:

From the example, it can be seen that the property’s Net Operating Income with no depreciation taken is $1MM, while it is reduced to $500k with the inclusion of the depreciation expense line item. Assuming a 35% tax rate, the $500k in depreciation expense results in $175k of tax savings in one year alone. Over the course of a multi-year investment holding period, the savings can be significant.

Given the obvious benefits of depreciation, it follows that the property owner has a strong incentive to maximize the amount of deductible depreciation that they take in a given year. IRS tax code allows for a property to be depreciated over 27.5 years (apartments) or 39 years (other commercial assets). So, for example, if a property has a value of $10M, the owner could deduct $256k per year ($10M / 39) in depreciation expense. But, the most experienced commercial real estate investors know that there is an advanced depreciation strategy called “Cost Segregation” that allows depreciation deductions to be accelerated, thereby maximizing the tax advantages from it.

In a Cost Segregation study, an owner hires an outside expert to review all components of the property and “segregate” them into buckets, for which depreciation can be accelerated. For example, furniture, fixtures, carpeting, and window treatments can be classified as “Personal Property” and depreciated over 5 or 7 years. Or, sidewalks, paving, and landscaping can be classified as “Land Improvements” and depreciated over 15 years. In either case, the shorter time horizon allows the depreciation deductions to be maximized, further reducing the property’s tax liability.

It should be noted however, that accelerated depreciation can be a double-edged sword. The increased tax deductions are great, but each one lower’s the property’s overall “cost basis.” When selling the property, the difference between the cost basis and the sales price is considered a gain and it is taxable and the then current capital gains tax rate. This is often referred to as “depreciation recapture” and it can catch many investors by surprise. To manage the tax bill associated with a gain of any amount, many investors like to utilize the other major tax benefit associated with commercial real estate investment, a “1031 Exchange.”

What is a 1031 Exchange?

Section 1031 of the Internal Revenue Service Tax Code allows an investor to defer taxes on the profitable sale of a property as long as they “exchange” the sale proceeds into another property that is considered to be “like kind.” There is no limit to the number of 1031 Exchanges that can be completed so, in theory, an investor could complete a series of successive exchanges over time, allowing their profits to grow tax deferred indefinitely.

In order to receive the tax breaks associated with a 1031 Exchange, there are a few rules that must be followed:

- Like Kind Test: The Replacement Property must be “of the same nature or character” as the Relinquished Property. In addition, it must be located in the United States and held for “productive use in a trade or business or for investment.”

- Time: From the sale date of the Relinquished Property, the Replacement Property must be identified within 45 calendar days and the purchase of it must be completed within 180 calendar days.

- Value: The market value and equity of the replacement property must be the same as, or greater than, the value of the relinquished property. For example, a property with a value of $5M and a mortgage of $3M must be exchanged into a property that is worth at least $5M with $3M worth of debt.

- No “Boot”: The term “boot” refers to any non-like kind property received in a 1031 Exchange. It could take the form of cash, installment notes, debt relief, or personal property and it is valued at “fair market value.” If boot is received, it doesn’t disqualify the exchange, but it could make it taxable.

- Held For Sale: The replacement property cannot be “held for sale.” In other words, it can’t be purchased for the tax deferral benefits, held for a short term, and then immediately sold. 1031 Exchange rules do not define a specific period of time that the replacement property must be held for, but it is generally agreed that a minimum of 12-24 months is a best practice.

- Same Taxpayer: The taxpayer associated with the relinquished property must be the same as the one associated with the replacement property. In addition, both properties need to be similarly titled.

- Property Type: A 1031 Exchange can be completed for any of the common commercial real estate property types including: apartment buildings/multifamily, retail, industrial, or office.

Depending on the specific needs of the investor, there are four types of 1031 Exchanges that can be utilized: the like-kind exchange, delayed exchange, reverse exchange, and construction or “improvement” exchange. Further, on occasion, the replacement property could be located in a tax advantaged district, known as an opportunity zone, that can add another layer of tax benefits to the transaction.

For investors and business owners who are smart about their use of 1031 Exchanges, they can grow their portfolio over time to include bigger and bigger properties based upon their realized tax savings. But, these transactions can be complicated, so it is always a good idea to work with a CPA, financial advisors, and/or qualified intermediary to ensure it is completed correctly.

Interested In Learning More?

First National Realty Partners is one of the country’s leading private equity commercial real estate investment firms. With an intentional focus on finding world-class, multi-tenanted assets well below intrinsic value, we seek to create superior long-term, risk-adjusted returns for our investors while creating strong economic assets for the communities we invest in.

As part of our value-add strategy, we seek to maximize property value by taking advantage of all available tax benefits. If you would like to learn more about our investment opportunities, contact us at (800) 605-4966 or info@fnrealtypartners.com for more information.