Every commercial real estate investor has different priorities. Some want stable, consistent cash flow and don’t care much about the potential for capital appreciation. Others have a higher risk appetite and are willing to pursue more growth. To accommodate differences in priorities, commercial firms typically place investment opportunities into one of four buckets that highlight the risk/return characteristics of the investment. One of these buckets is known as “value-add.”

In this article, we are going to discuss value-add commercial real estate investments. We will describe what they are, how they work, and who they may be a good fit for. By the end, readers will have all the information needed to determine if a value-add commercial real estate opportunity is right for their personal investment strategy.

First National Realty Partners is a private equity commercial real estate investment firm that specializes in the purchase and management of grocery store anchored retail centers. If you are an accredited investor and would like to learn more about our current opportunities, click here.

What is a Value-Add Commercial Real Estate Strategy?

Again, most commercial real estate investments fall into one of four buckets that describe the risk/return profile of an investment opportunity. At one end of the spectrum are “core” investments, which are the most stable, consistent opportunities that are akin to buying a highly rated bond. For example, a triple-net leased, single tenant property like CVS is a core asset. At the other end of the spectrum are “opportunistic” investments, which are the riskiest, such as ground up development. Somewhere in the middle is a strategy known as “value-add.”

Value-add commercial real estate assets are those that generate existing income but also need some improvements to provide attractive rates of return. Needed property upgrades can be operational (like cost cutting) or physical (like a new roof) and often include a combination of both. Investors who acquire value-add properties see their potential and create precise business plans to pursue growth in both value and net operating income.

What is Net Operating Income?

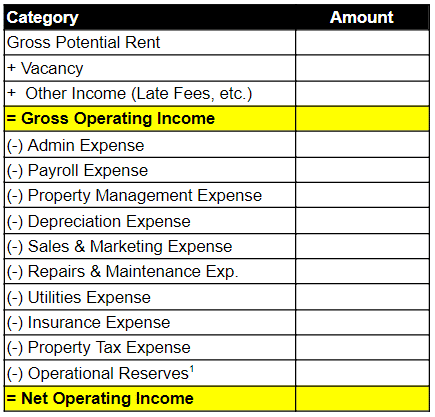

Net operating income (NOI) is a widely used and critically important operational metric that measures profitability of a commercial property and it is calculated as revenues less projected operating expenses.

The benefit of using NOI when considering the feasibility of an investment is that it takes into consideration all of the necessary income and operating expenditures for a property in one simple calculation. However, it is important to note that NOI does not take into consideration: mortgage payments (debt service), income taxes, depreciation, tenant improvements, or capital expenditures.

To illustrate how NOI is used to determine value, consider the following example.

A Net Operating Income (NOI) Example

To expand on the formula above, Net Operating Income is calculated as: (Gross Operating Income + Other Income) – Operating Expenses. For example suppose a property produced $250,000 in income and had $150,000 in operating expenses, the resulting NOI would be $100,000.

With NOI calculated, a “cap rate” can be applied to the result to estimate property value. For example, a property that produces $100,000 in NOI with a 7% cap rate would have an estimated value of $1.428M ($100,000/7%). It is within this calculation that the magic of the value-add investment comes alive.

Overview of the Value-Add Approach to Commercial Real Estate Investment

As described above, value-add commercial real estate assets are those that have good locations and fundamentals, but also have some form of operational, physical, or financial stress. As such, the basic idea behind a value-add strategy is to purchase the property for a good price and then pursue one or more strategies designed to increase NOI.

The most popular strategies are highlighted below.

Renovations

When assets are not properly maintained they can deteriorate or become outdated. As a result, rents can fall below market rates which has a negative impact on NOI.

Investors targeting a value-add approach are often able to acquire these assets at a sizable discount and then invest capital to improve the property to then current market standards. For example, popular renovations include roof repairs, the installation of energy-efficient systems, ADA upgrades, and bathroom remodels. Upgrading these components of a building can allow rents to be raised, thereby increasing NOI as long as expenses stay the same. At a 7% cap rate, every $1 increase in NOI equates to a ~$14 increase in property value.

Insourcing

Firms with a high level of expertise can insource functions that were previously outsourced to third-party vendors. For example, FNRP has our own in-house property management team so we typically insource this function as part of our value-add strategy, which sends the savings right to NOI.

Typical property management fees can range anywhere from 8-10% of gross revenue. So, bringing property management in-house can create significant cost savings and boost NOI materially.

Market Adjustments

In high growth markets, it is not uncommon for commercial market rents to grow faster than property owners raise them. As a result, investors may find property that is in good physical shape but rents space to tenants at rates that are significantly below the local market rate.

When this happens, an investment property may be generating less NOI than its full potential. This means that new owners have an opportunity to make a “market adjustment” in rental rates when leases come up for renewal.

Expense Management

Experienced value-add investors have a good understanding of the operating expense line items that are common in commercial real estate investments. As such, they can quickly identify areas for reduction without impacting the quality of the tenant experience.

For example, a new owner may be able to reduce administrative expenses, renegotiate service contracts, or find a more efficient way to do things. Whatever the approach, the key outcome is the same, lower expenses and higher NOI.

Tenant Mix

Certain tenants rely on complementary businesses to drive foot traffic and increase revenues. Anchor tenants like grocery stores have dependable revenues due to their essential nature and can help surrounding businesses perform to a higher standard.

Value-add real estate investors know that improving a property’s tenant mix leads to a better-performing asset, which leads to higher rents, and ultimately increased NOI. Updating a property’s tenant mix can be done by completing a comprehensive evaluation of the existing tenant base to determine the optimal rents associated with each. If a desirable anchor tenant is leased up, surrounding businesses are often willing to pay a premium because of these factors. Thus, the investor can achieve higher overall rents and improve the NOI of the property.

Light Value-Add vs. Heavy Value-Add

Not all value-add strategies require the same amount of effort. In CRE parlance, these differences are known as either “light value-add” or “heavy value-add.”

Increasing returns in light value-add investments are more commonly associated with improved income generation, like insourcing property management or renegotiating service contracts. These strategies do not require a significant amount of effort, but can result in “quick wins” with improvements to NOI.

On the contrary, increasing returns in heavy value-add investments are more associated with appreciation in the value of the assets as the result of high effort physical improvements like significant renovations or additions.

Again, in either case, the goal of the value-add efforts is to increase Net Operating Income and to drive higher returns.

Value-Add vs. Core, Core-Plus, and Opportunistic Commercial Real Estate Investments

As described in the introduction to the article, there are four buckets of CRE investment strategies that are indicative of the level of risk and associated return. Aside, from Value-Add, the other three are: core investments, core-plus investments, and opportunistic investments. To provide the proper context for a value-add real estate investment strategy, these buckets are described in detail below.

Core Investments

Core investments are the safest, most stable investments and consist of high quality (e.g. Class A) real estate assets in major metropolitan areas. They sit at the bottom of the risk-return ladder and are usually best-in-class properties with stable occupancy and high-credit tenants. An example of a core property type would be a newly built, state-of-the-art office tower in New York City. Annualized rates of return typically range from 5-10%.

Core-Plus Investments

Core-Plus assets have many of the same features as core investments but with one or more added risk factors. For example, they may be slightly older, have tenants with higher credit risk profiles, or sub-optimal locations.

An example of a core-plus investment would be a 10-20 year old office building in Chicago that is several blocks removed from what is considered a “prime” location. Annualized rates of return usually range from 10-14%.

Opportunistic Investments

Opportunistic real estate investments are high risk and generally involve a very robust business plan to improve utility. There may be major obstacles to overcome like extremely low occupancy levels or a major structural deficiency. Or, the business plan could include ground-up development.

If the business plan is successfully executed, investors may see annualized rates of return in excess of 20% on these assets.

When is Value-Add Commercial Real Estate the Right Investment?

Determining whether a value-add commercial real estate investment is the right choice depends on a number of factors including appetite for risk. As we’ve outlined above, value-add commercial real estate investments fall in the upper/middle section of the risk and return matrix. These investments require a level of sophistication from the investor to achieve adequate renovations, insourcing, market adjustments, proper expense management, and adequate tenant mix. Investing in value-add assets can prove very profitable if the right business plan is developed, which is why you should consult with a real estate expert before determining if this is the right investment for you.

Value-Add Commercial Real Estate – An Example

To illustrate how effective value-add strategy can be, consider a very simple example.

At purchase, suppose a property produces $100,000 in income and has $50,000 in expenses. The resulting NOI is $50,000. At a 6% cap rate, the estimated value is $833,000 ($50,000/6%).

Now, assume that an investor purchases this property and insources the property management function while completing renovations to attract higher paying tenants. As a result, income increases to $125,000 while expenses fall to $40,000. In this scenario, the new NOI is $85,000. At the same 6% cap rate, the estimated value increases to $1.4M.

This simple example demonstrates why a value-add investment strategy can be so lucrative – a concept known as “forced appreciation.” By pursuing a value add strategy, investors can “force” the property to appreciate by improving NOI, which happens regardless of market conditions.

How to Find Value-Add Commercial Real Estate Investments

There are a number of ways to find value-add commercial real estate investment opportunities, but the most common include an internet search, banks, investment firms, financial advisors, or networking with real estate investors.

Summary of Value-Add Commercial Real Estate Investments

A value-add commercial real estate investment strategy is one that involves buying real estate property that has some minor blemishes and investing time and effort to improve them so that they increase in value.

The key concept in understanding a value-add strategy is known as net operating income, which is a metric that measures the operational profitability of a property. It is calculated as income less operating expenses.

The core of a value-add strategy is to pursue strategies that increase income, decrease expenses, or both in an effort to boost NOI, and thus a property’s value.

Interested in Learning More?

First National Realty Partners is one of the country’s leading private equity commercial real estate investment firms. With an intentional focus on finding world-class, multi-tenanted assets well below intrinsic value, we seek to create superior long-term, risk-adjusted returns for our investors while creating strong economic assets for the communities we invest in.

If you are an Accredited Real Estate Investor and want to learn more about our investment opportunities, contact us at (800) 605-4966 or ir@fnrpusa.com for more information.

Although the specific line items may vary by property type (multifamily, office buildings, retail, etc) and asset class (Class A, Class B, etc), the Net Operating Income calculation is generally the same for all of them. It is a property’s income, less all of the expenses required to operate it (which includes the vacancy rate). To fully understand how it is calculated, it can be helpful to view it in the same way it may appear in a proforma or financial statement:

By pursuing changes to any one or all of these line items a commercial property owner can directly impact a property’s Net Operating Income and this idea is the basis for the “value-add” investment strategy.

Overview of Value Add Commercial Real Estate Investment

In many of our commercial real estate acquisitions, we build our business plan around a value-add approach, which means that we purposely seek out properties with excellent locations and fundamentals, but also some level of physical, operational, or financial stress.

When we find these “value-add properties,” we perform a significant amount of due diligence on the property, leasing activity, operating expenses, and the local real estate market to determine the potential rate of return. If everything checks out, we attempt to acquire these properties at a discount to their intrinsic value and then apply our operational expertise to “add value” over the course of the investment holding period.

Tactically, the process of adding value just means pursuing strategies to either increase income, decrease expenses, or both. The exact strategy is unique to the property and its needs, but it can take a variety of forms, including:

Renovations

If an asset is not property maintained, the structure, architecture, tenant base, and landscaping can deteriorate and become outdated. Because of this, rents can suffer and fall below market rates. In such cases, it can be possible to acquire the property for a discount and then invest some amount of capital in the physical improvements needed to improve the property to market standards. In doing so, rents can be raised, which increases the property’s income. As long as operational expenses stay relatively consistent, the net effect should be an increase on Net Operating Income.

Insourcing

Investors and firms with a high level of operational expertise can “insource” certain functions that are performed by third party vendors and do the same for cheaper. For example, we have our own in-house property management team so we like to insource this function because we have demonstrated that we can do it better and cheaper. In a typical asset, the property management expense line item can cost up to 8% – 10% of Gross Revenue so this represents a significant cost savings that goes directly towards increasing Net Operating Income.

Market Adjustments

On occasion, a property may be in good shape, but the owner may not have done a very good job of negotiating leases and lease renewals. As a result, there can be a material difference between a property’s current rents and market rents. In such cases, a new owner can step in and proactively negotiate higher rates when existing leases come up for renewal, which goes directly towards increasing Net Operating Income.

Expense Management

Experienced investors know that there are general rules of thumb for each expense line item and they have the ability to spot if one of them is out of whack. If this is the case, a new owner can come in and perform a detailed review of each expense line item to determine if it can be decreased without impacting the overall operation of the property. For example, if a market has experienced an economic contraction, a new owner can come in and challenge the property’s tax assessment. If they are successful, the property may be re-assessed for a lower value, leading to lower taxes, which leads to increased Net Operating Income.

Tenant Mix

Certain types of tenants have complementary businesses and like to be near each other and they are willing to pay a premium to do it. So, a new owner could purchase a property, evaluate the tenant base, and make proactive decisions to change it in an effort to achieve higher rents. For example, we like grocery store anchored shopping centers and there are a number of tenants that like to co-exist in the same center to take advantage of the traffic generated by the grocery store. These include quick service restaurants, fitness studios, and bank branches. Given our long standing relationships with many of these types of businesses, we can work with them to replace old tenants with new tenants and achieve higher Net Operating Income in the process. Ideally, the new businesses will be quality tenants on long term leases. Lenders and real estate investors prefer this, so the strategy can lead to higher occupancy, lower risk and higher returns.

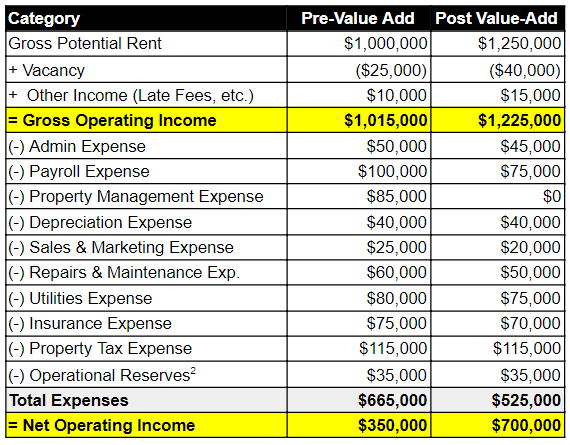

In reality, an investor may try some combination of all of these strategies in an effort to maximize the property’s Net Operating Income. To understand how impactful this can be, an example is helpful.

Value-Add – An Example

The following table illustrates a before and after example of executing a value-add strategy for an acquired asset. It should be noted that these changes do not happen overnight. In some cases, it can take years of dedicated focus and consistent execution to realize the benefits.

In this example, the property’s Net Operating Income is doubled through a combination of income increases and expense decreases. Assuming a 7% real estate cap rate, the property owner was able to “force” the value to increase from $5,000,000 ($350,000 / 7%) to $10,000,000 ($700,000 / 7%) over the investment holding period. This does not account for any additional, market-driven, changes, which could push the value even higher.

The point is this, a “value-add” approach is a tried and true method for investors and transaction sponsors to leverage their operational expertise to pursue a number of different strategies, all of which are designed to increase a property’s Net Operating Income, and this its value.

Interested In Learning More?

First National Realty Partners is one of the country’s leading private equity commercial real estate investment firms. With an intentional focus on finding world-class, multi-tenanted assets well below intrinsic value, we utilize a value-add approach to create superior long-term, risk-adjusted returns for our investors while creating strong economic assets for the communities we invest in.

To learn more about our investment opportunities, contact us at (800) 605-4966 or ir@fnrpusa.com for more information.

Understanding Value-Add Commercial Real Estate

Every commercial real estate investor has different priorities. Some want stable, consistent cash flow and don’t care much about the potential for capital appreciation. Others have a higher risk appetite and are willing to pursue more growth. To accommodate differences in priorities, commercial firms typically place investment opportunities into one of four buckets that highlight the risk/return characteristics of the investment. One of these buckets is known as “value-add.”

In this article, we are going to discuss value-add commercial real estate investments. We will describe what they are, how they work, and who they may be a good fit for. By the end, readers will have all the information needed to determine if a value-add commercial real estate opportunity is right for their personal investment strategy.

First National Realty Partners is a private equity commercial real estate investment firm that specializes in the purchase and management of grocery store anchored retail centers. If you are an accredited investor and would like to learn more about our current opportunities, click here.

What is a Value-Add Commercial Real Estate Strategy?

Again, most commercial real estate investments fall into one of four buckets that describe the risk/return profile of an investment opportunity. At one end of the spectrum are “core” investments, which are the most stable, consistent opportunities that are akin to buying a highly rated bond. For example, a triple-net leased, single tenant property like CVS is a core asset. At the other end of the spectrum are “opportunistic” investments, which are the riskiest, such as ground up development. Somewhere in the middle is a strategy known as “value-add.”

Value-add commercial real estate assets are those that generate existing income but also need some improvements to provide attractive rates of return. Needed property upgrades can be operational (like cost cutting) or physical (like a new roof) and often include a combination of both. Investors who acquire value-add properties see their potential and create precise business plans to pursue growth in both value and net operating income.

What is Net Operating Income?

Net operating income (NOI) is a widely used and critically important operational metric that measures profitability of a commercial property and it is calculated as revenues less projected operating expenses.

The benefit of using NOI when considering the feasibility of an investment is that it takes into consideration all of the necessary income and operating expenditures for a property in one simple calculation. However, it is important to note that NOI does not take into consideration: mortgage payments (debt service), income taxes, depreciation, tenant improvements, or capital expenditures.

To illustrate how NOI is used to determine value, consider the following example.

A Net Operating Income (NOI) Example

To expand on the formula above, Net Operating Income is calculated as: (Gross Operating Income + Other Income) – Operating Expenses. For example suppose a property produced $250,000 in income and had $150,000 in operating expenses, the resulting NOI would be $100,000.

With NOI calculated, a “cap rate” can be applied to the result to estimate property value. For example, a property that produces $100,000 in NOI with a 7% cap rate would have an estimated value of $1.428M ($100,000/7%). It is within this calculation that the magic of the value-add investment comes alive.

Overview of the Value-Add Approach to Commercial Real Estate Investment

As described above, value-add commercial real estate assets are those that have good locations and fundamentals, but also have some form of operational, physical, or financial stress. As such, the basic idea behind a value-add strategy is to purchase the property for a good price and then pursue one or more strategies designed to increase NOI.

The most popular strategies are highlighted below.

Renovations

When assets are not properly maintained they can deteriorate or become outdated. As a result, rents can fall below market rates which has a negative impact on NOI.

Investors targeting a value-add approach are often able to acquire these assets at a sizable discount and then invest capital to improve the property to then current market standards. For example, popular renovations include roof repairs, the installation of energy-efficient systems, ADA upgrades, and bathroom remodels. Upgrading these components of a building can allow rents to be raised, thereby increasing NOI as long as expenses stay the same. At a 7% cap rate, every $1 increase in NOI equates to a ~$14 increase in property value.

Insourcing

Firms with a high level of expertise can insource functions that were previously outsourced to third-party vendors. For example, FNRP has our own in-house property management team so we typically insource this function as part of our value-add strategy, which sends the savings right to NOI.

Typical property management fees can range anywhere from 8-10% of gross revenue. So, bringing property management in-house can create significant cost savings and boost NOI materially.

Market Adjustments

In high growth markets, it is not uncommon for commercial market rents to grow faster than property owners raise them. As a result, investors may find property that is in good physical shape but rents space to tenants at rates that are significantly below the local market rate.

When this happens, an investment property may be generating less NOI than its full potential. This means that new owners have an opportunity to make a “market adjustment” in rental rates when leases come up for renewal.

Expense Management

Experienced value-add investors have a good understanding of the operating expense line items that are common in commercial real estate investments. As such, they can quickly identify areas for reduction without impacting the quality of the tenant experience.

For example, a new owner may be able to reduce administrative expenses, renegotiate service contracts, or find a more efficient way to do things. Whatever the approach, the key outcome is the same, lower expenses and higher NOI.

Tenant Mix

Certain tenants rely on complementary businesses to drive foot traffic and increase revenues. Anchor tenants like grocery stores have dependable revenues due to their essential nature and can help surrounding businesses perform to a higher standard.

Value-add real estate investors know that improving a property’s tenant mix leads to a better-performing asset, which leads to higher rents, and ultimately increased NOI. Updating a property’s tenant mix can be done by completing a comprehensive evaluation of the existing tenant base to determine the optimal rents associated with each. If a desirable anchor tenant is leased up, surrounding businesses are often willing to pay a premium because of these factors. Thus, the investor can achieve higher overall rents and improve the NOI of the property.

Light Value-Add vs. Heavy Value-Add

Not all value-add strategies require the same amount of effort. In CRE parlance, these differences are known as either “light value-add” or “heavy value-add.”

Increasing returns in light value-add investments are more commonly associated with improved income generation, like insourcing property management or renegotiating service contracts. These strategies do not require a significant amount of effort, but can result in “quick wins” with improvements to NOI.

On the contrary, increasing returns in heavy value-add investments are more associated with appreciation in the value of the assets as the result of high effort physical improvements like significant renovations or additions.

Again, in either case, the goal of the value-add efforts is to increase Net Operating Income and to drive higher returns.

Value-Add vs. Core, Core-Plus, and Opportunistic Commercial Real Estate Investments

As described in the introduction to the article, there are four buckets of CRE investment strategies that are indicative of the level of risk and associated return. Aside, from Value-Add, the other three are: core investments, core-plus investments, and opportunistic investments. To provide the proper context for a value-add real estate investment strategy, these buckets are described in detail below.

Core Investments

Core investments are the safest, most stable investments and consist of high quality (e.g. Class A) real estate assets in major metropolitan areas. They sit at the bottom of the risk-return ladder and are usually best-in-class properties with stable occupancy and high-credit tenants. An example of a core property type would be a newly built, state-of-the-art office tower in New York City. Annualized rates of return typically range from 5-10%.

Core-Plus Investments

Core-Plus assets have many of the same features as core investments but with one or more added risk factors. For example, they may be slightly older, have tenants with higher credit risk profiles, or sub-optimal locations.

An example of a core-plus investment would be a 10-20 year old office building in Chicago that is several blocks removed from what is considered a “prime” location. Annualized rates of return usually range from 10-14%.

Opportunistic Investments

Opportunistic real estate investments are high risk and generally involve a very robust business plan to improve utility. There may be major obstacles to overcome like extremely low occupancy levels or a major structural deficiency. Or, the business plan could include ground-up development.

If the business plan is successfully executed, investors may see annualized rates of return in excess of 20% on these assets.

When is Value-Add Commercial Real Estate the Right Investment?

Determining whether a value-add commercial real estate investment is the right choice depends on a number of factors including appetite for risk. As we’ve outlined above, value-add commercial real estate investments fall in the upper/middle section of the risk and return matrix. These investments require a level of sophistication from the investor to achieve adequate renovations, insourcing, market adjustments, proper expense management, and adequate tenant mix. Investing in value-add assets can prove very profitable if the right business plan is developed, which is why you should consult with a real estate expert before determining if this is the right investment for you.

Value-Add Commercial Real Estate – An Example

To illustrate how effective value-add strategy can be, consider a very simple example.

At purchase, suppose a property produces $100,000 in income and has $50,000 in expenses. The resulting NOI is $50,000. At a 6% cap rate, the estimated value is $833,000 ($50,000/6%).

Now, assume that an investor purchases this property and insources the property management function while completing renovations to attract higher paying tenants. As a result, income increases to $125,000 while expenses fall to $40,000. In this scenario, the new NOI is $85,000. At the same 6% cap rate, the estimated value increases to $1.4M.

This simple example demonstrates why a value-add investment strategy can be so lucrative – a concept known as “forced appreciation.” By pursuing a value add strategy, investors can “force” the property to appreciate by improving NOI, which happens regardless of market conditions.

How to Find Value-Add Commercial Real Estate Investments

There are a number of ways to find value-add commercial real estate investment opportunities, but the most common include an internet search, banks, investment firms, financial advisors, or networking with real estate investors.

Summary of Value-Add Commercial Real Estate Investments

A value-add commercial real estate investment strategy is one that involves buying real estate property that has some minor blemishes and investing time and effort to improve them so that they increase in value.

The key concept in understanding a value-add strategy is known as net operating income, which is a metric that measures the operational profitability of a property. It is calculated as income less operating expenses.

The core of a value-add strategy is to pursue strategies that increase income, decrease expenses, or both in an effort to boost NOI, and thus a property’s value.

Interested in Learning More?

First National Realty Partners is one of the country’s leading private equity commercial real estate investment firms. With an intentional focus on finding world-class, multi-tenanted assets well below intrinsic value, we seek to create superior long-term, risk-adjusted returns for our investors while creating strong economic assets for the communities we invest in.If you are an Accredited Real Estate Investor and want to learn more about our investment opportunities, contact us at (800) 605-4966 or ir@fnrpusa.com for more information.